Flying for free using points is a popular strategy among frequent travelers. Here’s a step-by-step guide on how to maximize your points and travel the world:

1. Choose Your Preferred Airlines: Research and identify airlines that offer routes to the destinations you want to visit and have loyalty programs with credit card partnerships. Consider factors like airline alliances (e.g., OneWorld, Star Alliance, SkyTeam) for more flexibility in booking.

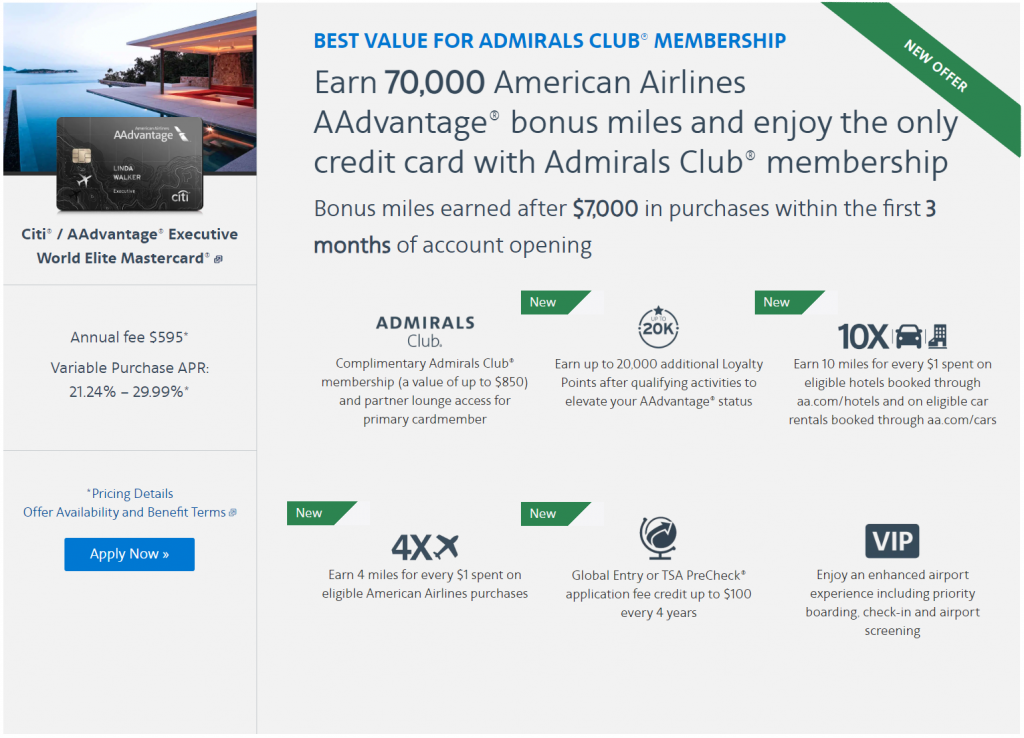

2. Sign Up for Airline-Specific Credit Cards: Once you’ve chosen your preferred airline(s), apply for their co-branded credit cards. These cards often come with substantial sign-up bonuses. Look for offers that provide a generous initial bonus of 50,000-75,000+ points when you meet the spending requirements within the specified timeframe.

3. Use Your Credit Card for Everyday Expenses: Make your airline-specific credit card your primary method of payment for everyday expenses such as groceries, gas, utility bills, dining, and more. Most cards offer 1-3 points for every dollar spent on eligible purchases, so maximize your spending to earn more points.

4. Meet Minimum Spending Requirements: To earn the sign-up bonus points, ensure you meet the minimum spending requirements within the specified time frame (typically the first 3 months after card activation). These bonus points can be a significant boost to your mileage account.

5. Accumulate Points: Continue to use your airline-specific credit card for all eligible expenses, and watch your points accumulate over time. Keep an eye out for special promotions or bonus point offers from the credit card issuer.

6. Plan Your Travel: Research and plan your trips well in advance. Check the airline’s reward chart to understand how many points are required for specific routes and travel classes. Some airlines also have dynamic pricing, so flexibility in your travel dates can help you save points.

7. Book Your Flights: When you have accumulated enough points, book your flights through the airline’s loyalty program website or by calling their customer service. You can often book both the flight and pay for taxes and fees using points.

8. Maximize Stopovers and Open Jaws: Take advantage of the airline’s stopover and open-jaw policies to visit multiple destinations on a single ticket. This can significantly increase the value of your points.

9. Consider Transferable Points Programs: Some credit cards offer transferable points programs, like Chase Ultimate Rewards, American Express Membership Rewards, or Citi ThankYou Points. You can transfer these points to various airline partners, providing even more flexibility in booking.

10. Be Strategic with Credit Card Benefits: Besides earning points, airline credit cards often come with additional benefits such as free checked bags, priority boarding, and lounge access. Make use of these perks to enhance your travel experience.

11. Maintain Your Credit Score: Be responsible with your credit card usage and payments to maintain a good credit score. A higher credit score can help you qualify for more credit cards and better offers.

12. Stay Informed: Keep an eye on changes in airline loyalty programs, credit card offers, and travel restrictions to maximize your travel savings.

By following these steps and staying diligent in your points accumulation and redemption efforts, you can fly for free or at a significantly reduced cost to destinations around the world using your credit card points.

Earning Points with the “American Airlines” Credit Card

Sign-Up Bonus: Apply for the “American Airlines” Credit Card, which currently offers a sign-up bonus of 60,000 points if you spend $3,000 within the first 3 months of account opening.

1. Everyday Expenses: Use your “American Airlines” Credit Card for everyday expenses:

Groceries: Spend $400 per month, earning 1 point for every dollar spent.

Gasoline: Spend $200 per month, earning 2 points for every dollar spent.

Dining Out: Spend $300 per month, earning 3 points for every dollar spent.

Utilities: Pay $100 for electricity and $50 for water each month, earning 1 point for every dollar spent.

2. Monthly Totals: In a typical month, your points earned would be as follows:

Groceries: 400 points

Gasoline: 400 points

Dining Out: 900 points

Utilities: 150 points

Total for the month: 1,850 points

Annual Total: Over the course of a year, you would earn approximately 22,200 points (1,850 points per month x 12 months).

Sign-Up Bonus: Assuming you met the spending requirements, you also receive the 60,000-point sign-up bonus.

Total Points Accrued in One Year: 82,200 points (22,200 points from everyday expenses + 60,000 points from the sign-up bonus).

With 82,200 points accumulated in a year using the “American Airlines” credit card, you can use these points to book flights or other travel-related expenses through American Airlines’ loyalty program, potentially allowing you to fly for free or at a significant discount. Remember that actual earnings may vary based on your spending habits and the terms and conditions of the specific credit card.